CAPM, a Review

Note that we will be using the Sharpe-Linter version of CAPM:

\begin{equation} E[R_{i}-R_{f}] = \beta_{im} E[(R_{m}-R_{f})] \end{equation}

\begin{equation} \beta_{im} := \frac{Cov[(R_{i}-R_{f}),(R_{m}-R_{f})]}{Var[R_{m}-R_{f}]} \end{equation}

Recall that we declare \(R_{f}\) (the risk-free rate) to be non-stochastic.

Let us begin. We will create a generic function to analyze some given stock.

Data Import

We will first import our utilities

import pandas as pd

import numpy as np

Let’s load the data from our market (NYSE) as well as our 10 year t-bill data.

t_bill = pd.read_csv("./linearity_test_data/10yrTBill.csv")

nyse = pd.read_csv("./linearity_test_data/NYSEComposite.csv")

nyse.head()

Date Close

0 11/7/2013 16:00:00 9924.37

1 11/8/2013 16:00:00 10032.14

2 11/11/2013 16:00:00 10042.95

3 11/12/2013 16:00:00 10009.84

4 11/13/2013 16:00:00 10079.89

Excellent. Let’s load in the data for that stock.

def load_stock(stock):

return pd.read_csv(f"./linearity_test_data/{stock}.csv")

load_stock("LMT").head()

Date Close

0 11/7/2013 16:00:00 136.20

1 11/8/2013 16:00:00 138.11

2 11/11/2013 16:00:00 137.15

3 11/12/2013 16:00:00 137.23

4 11/13/2013 16:00:00 137.26

Raw Data

And now, let’s load all three stocks, then concatenate them all into a big-ol DataFrame.

# load data

df = { "Date": nyse.Date,

"NYSE": nyse.Close,

"TBill": t_bill.Close,

"LMT": load_stock("LMT").Close,

"TWTR": load_stock("TWTR").Close,

"MCD": load_stock("MCD").Close }

# convert to dataframe

df = pd.DataFrame(df)

# drop empty

df.dropna(inplace=True)

df

Date NYSE TBill LMT TWTR MCD

0 11/7/2013 16:00:00 9924.37 26.13 136.20 44.90 97.20

1 11/8/2013 16:00:00 10032.14 27.46 138.11 41.65 97.01

2 11/11/2013 16:00:00 10042.95 27.51 137.15 42.90 97.09

3 11/12/2013 16:00:00 10009.84 27.68 137.23 41.90 97.66

4 11/13/2013 16:00:00 10079.89 27.25 137.26 42.60 98.11

... ... ... ... ... ... ...

2154 10/24/2022 16:00:00 14226.11 30.44 440.11 39.60 252.21

2155 10/25/2022 16:00:00 14440.69 31.56 439.30 39.30 249.28

2156 10/26/2022 16:00:00 14531.69 33.66 441.11 39.91 250.38

2157 10/27/2022 16:00:00 14569.90 34.83 442.69 40.16 248.36

2158 10/28/2022 16:00:00 14795.63 33.95 443.41 39.56 248.07

[2159 rows x 6 columns]

Log Returns

Excellent. Now, let’s convert all of these values into daily log-returns (we don’t really care about the actual pricing.)

log_returns = df[["NYSE", "TBill", "LMT", "TWTR", "MCD"]].apply(np.log, inplace=True)

df.loc[:, ["NYSE", "TBill", "LMT", "TWTR", "MCD"]] = log_returns

df

Date NYSE TBill LMT TWTR MCD

0 11/7/2013 16:00:00 9.202749 3.263084 4.914124 3.804438 4.576771

1 11/8/2013 16:00:00 9.213549 3.312730 4.928050 3.729301 4.574814

2 11/11/2013 16:00:00 9.214626 3.314550 4.921075 3.758872 4.575638

3 11/12/2013 16:00:00 9.211324 3.320710 4.921658 3.735286 4.581492

4 11/13/2013 16:00:00 9.218298 3.305054 4.921877 3.751854 4.586089

... ... ... ... ... ... ...

2154 10/24/2022 16:00:00 9.562834 3.415758 6.087025 3.678829 5.530262

2155 10/25/2022 16:00:00 9.577805 3.451890 6.085183 3.671225 5.518577

2156 10/26/2022 16:00:00 9.584087 3.516310 6.089294 3.686627 5.522980

2157 10/27/2022 16:00:00 9.586713 3.550479 6.092870 3.692871 5.514879

2158 10/28/2022 16:00:00 9.602087 3.524889 6.094495 3.677819 5.513711

[2159 rows x 6 columns]

And now, the log returns! We will shift this data by one column and subtract.

returns = df.drop(columns=["Date"]) - df.drop(columns=["Date"]).shift(1)

returns.dropna(inplace=True)

returns

NYSE TBill LMT TWTR MCD

1 0.010801 0.049646 0.013926 -0.075136 -0.001957

2 0.001077 0.001819 -0.006975 0.029570 0.000824

3 -0.003302 0.006161 0.000583 -0.023586 0.005854

4 0.006974 -0.015657 0.000219 0.016568 0.004597

5 0.005010 -0.008476 0.007476 0.047896 -0.005622

... ... ... ... ... ...

2154 0.005785 0.004940 -0.023467 -0.014291 0.001349

2155 0.014971 0.036133 -0.001842 -0.007605 -0.011685

2156 0.006282 0.064420 0.004112 0.015402 0.004403

2157 0.002626 0.034169 0.003575 0.006245 -0.008100

2158 0.015374 -0.025590 0.001625 -0.015053 -0.001168

[2158 rows x 5 columns]

Risk-Free Excess

Recall that we want to be working with the excess-to-risk-free rates \(R_{T}-R_{f}\), where \(R_{T}\) is some security. So, we will go through and subtract everything by the risk-free rate (and drop the RFR itself):

risk_free_excess = returns.drop(columns="TBill").apply(lambda x: x-returns.TBill)

risk_free_excess

NYSE LMT TWTR MCD

1 -0.038846 -0.035720 -0.124783 -0.051603

2 -0.000742 -0.008794 0.027751 -0.000995

3 -0.009463 -0.005577 -0.029747 -0.000307

4 0.022630 0.015875 0.032225 0.020254

5 0.013486 0.015952 0.056372 0.002854

... ... ... ... ...

2154 0.000845 -0.028406 -0.019231 -0.003591

2155 -0.021162 -0.037975 -0.043738 -0.047818

2156 -0.058138 -0.060308 -0.049017 -0.060017

2157 -0.031543 -0.030593 -0.027924 -0.042269

2158 0.040964 0.027215 0.010537 0.024422

[2158 rows x 4 columns]

Actual Regression

It is now time to perform the actual linear regression! We will use statsmodels’ Ordinary Least Squares API to make our work easier, but we will go through a full regression in the end.

import statsmodels.api as sm

CAPM Regression: Lockheed Martin

Let’s work with Lockheed Martin first for regression, fitting an ordinary least squares. Remember that the OLS functions reads the endogenous variable first (for us, the return of the asset.)

# add a column of ones to our input market excess returns

nyse_with_bias = sm.add_constant(risk_free_excess.NYSE)

# perform linreg

lmt_model = sm.OLS(risk_free_excess.LMT, nyse_with_bias).fit()

lmt_model.summary()

OLS Regression Results

==============================================================================

Dep. Variable: LMT R-squared: 0.859

Model: OLS Adj. R-squared: 0.859

Method: Least Squares F-statistic: 1.312e+04

No. Observations: 2158 AIC: -1.263e+04

Df Residuals: 2156 BIC: -1.262e+04

Df Model: 1 Prob (F-statistic): 0.00

Covariance Type: nonrobust Log-Likelihood: 6318.9

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 0.0004 0.000 1.311 0.190 -0.000 0.001

NYSE 0.9449 0.008 114.552 0.000 0.929 0.961

==============================================================================

Based on the constants row, we can see that—within \(95\%\) confidence—the intercept is generally \(0\) and CAPM applies. However, we do see a slight positive compared to the market. Furthermore, we can see that the regression has a beta value of \(0.9449\) — according the CAPM model, it being slightly undervarying that the market.

CAPM Regression: MacDonald’s

# perform linreg

mcd_model = sm.OLS(risk_free_excess.MCD, nyse_with_bias).fit()

mcd_model.summary()

OLS Regression Results

==============================================================================

Dep. Variable: MCD R-squared: 0.887

Model: OLS Adj. R-squared: 0.887

Method: Least Squares F-statistic: 1.697e+04

No. Observations: 2158 AIC: -1.310e+04

Df Residuals: 2156 BIC: -1.309e+04

Df Model: 1 Prob (F-statistic): 0.00

Covariance Type: nonrobust Log-Likelihood: 6551.1

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 0.0003 0.000 1.004 0.315 -0.000 0.001

NYSE 0.9651 0.007 130.287 0.000 0.951 0.980

==============================================================================

Same thing as before, we are within \(95\%\) confidence having a intercept of \(0\) (with a slight positive edge), and it looks like MacDonald’s vary a little bit more than Lockheed Martin. The food industry is probably a tougher business than that in defense.

CAPM Regression: Twitter

Lastly, to analyze the recently delisted Twitter!

# perform linreg

twtr_model = sm.OLS(risk_free_excess.TWTR, nyse_with_bias).fit()

twtr_model.summary()

OLS Regression Results

==============================================================================

Dep. Variable: TWTR R-squared: 0.522

Model: OLS Adj. R-squared: 0.522

Method: Least Squares F-statistic: 2357.

No. Observations: 2158 AIC: -8610.

Df Residuals: 2156 BIC: -8599.

Df Model: 1 Prob (F-statistic): 0.00

Covariance Type: nonrobust Log-Likelihood: 4307.1

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const -0.0002 0.001 -0.346 0.730 -0.002 0.001

NYSE 1.0173 0.021 48.549 0.000 0.976 1.058

==============================================================================

Evidently, Twitter is much more variable. It looks like it has a nontrivial bias (the intercept being -0.001 being within the \(95\%\) confidence band — that the security is possibly significantly underperforming the CAPM expectation in the market.) Furthermore, we have a positive beta value: that the asset is more variable than the market.

Manual Checking

We can also use the betas formula to manually calculate what we expect for the beta values (i.e. as if they were one IID random variable.)

risk_free_cov = risk_free_excess.cov()

risk_free_cov

NYSE LMT TWTR MCD

NYSE 0.001143 0.001080 0.001163 0.001103

LMT 0.001080 0.001188 0.001116 0.001083

TWTR 0.001163 0.001116 0.002264 0.001155

MCD 0.001103 0.001083 0.001155 0.001200

Finally, to construct the beta values. Recall that:

\begin{equation} \beta_{im} := \frac{Cov[(R_{i}-R_{f}),(R_{m}-R_{f})]}{Var[R_{m}-R_{f}]} \end{equation}

and that:

\begin{equation} Var[X] = Cov[X,X], \forall X \end{equation}

# get the market variance (covariance with itself)

market_variation = risk_free_cov.NYSE.NYSE

# calculate betas

betas = {"LMT": (risk_free_cov.LMT.NYSE/market_variation),

"TWTR": (risk_free_cov.TWTR.NYSE/market_variation),

"MCD": (risk_free_cov.MCD.NYSE/market_variation)}

# and make dataframe

betas = pd.Series(betas)

betas

LMT 0.944899

TWTR 1.017294

MCD 0.965081

dtype: float64

Apparently, all of our assets swing less than the overall NYSE market! Especially Lockheed—it is only \(94.4\%\) of the market variation. Furthermore, it is interesting to see that Twitter swings much more dramatically compared to the market.

Equal-Part Fund

We will now create two funds with the three securities, one with equal parts and one which attempts to maximizes the bias (max returns) while minimizing the beta variance value compared to the market.

First, let’s create a baseline fund in equal parts. Here it is:

fund_1_returns = returns.LMT + returns.TWTR + returns.MCD

fund_1_returns

1 -0.063167

2 0.023420

3 -0.017149

4 0.021384

5 0.049750

...

2154 -0.036409

2155 -0.021132

2156 0.023917

2157 0.001720

2158 -0.014596

Length: 2158, dtype: float64

We will calculate the excess returns of this fund:

fund_1_excess = fund_1_returns-returns.TBill

fund_1_excess

1 -0.112813

2 0.021600

3 -0.023310

4 0.037041

5 0.058226

...

2154 -0.041349

2155 -0.057265

2156 -0.040503

2157 -0.032449

2158 0.010994

Length: 2158, dtype: float64

Performance of the Equal-Part Fund

# perform linreg

fund_1_model = sm.OLS(fund_1_excess, nyse_with_bias).fit()

fund_1_model.summary()

OLS Regression Results

==============================================================================

Dep. Variable: y R-squared: 0.473

Model: OLS Adj. R-squared: 0.473

Method: Least Squares F-statistic: 1935.

No. Observations: 2158 AIC: -7735.

Df Residuals: 2156 BIC: -7724.

Df Model: 1 Prob (F-statistic): 3.01e-302

Covariance Type: nonrobust Log-Likelihood: 3869.5

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 0.0007 0.001 0.841 0.401 -0.001 0.002

NYSE 1.1290 0.026 43.993 0.000 1.079 1.179

==============================================================================

Surprisingly, we have now created a significantly riskier investment that, though riskier, generates a much higher probability of reward (\(+0.001\) is now within the \(99\%\) band!)

A More Optimized Fund

To me, this is the payoff of this assignment. We will now use CAPM to create the “best” fund combination—given some variance, the funds which match CAPM. To do this, let’s create a generic linear combination of the assets.

import sympy as sym

x = sym.Symbol('x')

y = sym.Symbol('y')

z = sym.Symbol('z')

fund_2_returns = x*returns.LMT + y*returns.TWTR + z*returns.MCD

fund_2_returns

1 0.0139260753744255*x - 0.0751364261353569*y - ...

2 -0.00697525170622448*x + 0.0295704573211193*y ...

3 0.000583132897928884*x - 0.0235859990058791*y ...

4 0.000218587198947517*x + 0.016568426347233*y +...

5 0.00747599199607762*x + 0.0478955096700351*y -...

...

2154 -0.0234665578621085*x - 0.0142913301107561*y +...

2155 -0.00184214468578059*x - 0.0076045993852194*y ...

2156 0.00411172646842317*x + 0.0154024001854269*y +...

2157 0.00357547337231878*x + 0.0062445563228315*y -...

2158 0.00162509910496933*x - 0.0150529686289622*y -...

Length: 2158, dtype: object

Excellent. We will also calculate the excess returns of this fund:

fund_2_excess = fund_2_returns-returns.TBill

Y = fund_2_excess.to_numpy()

Y

[0.0139260753744255*x - 0.0751364261353569*y - 0.00195664549320096*z - 0.0496463208073039

-0.00697525170622448*x + 0.0295704573211193*y + 0.000824317408861575*z - 0.00181917459665826

0.000583132897928884*x - 0.0235859990058791*y + 0.00585367525146019*z - 0.00616055581298536

...

0.00411172646842317*x + 0.0154024001854269*y + 0.00440300114913317*z - 0.0644196927849867

0.00357547337231878*x + 0.0062445563228315*y - 0.0081004573348249*z - 0.0341688956152497

0.00162509910496933*x - 0.0150529686289622*y - 0.00116834209450634*z + 0.0255902303732043]

We cast this type to a numpy array because we are about to perform some matrix operations upon it.

Optimizing the Optimized Fund: Linreg

Now, let us perform the actual linear regression ourselves. Recall that the pseudoinverse linear regression estimator is:

\begin{equation} \beta = (X^{T}X)^{-1}X^{T}Y \end{equation}

We have already our \(Y\) as a vector (above), and our \(X\) is:

X = nyse_with_bias.to_numpy()

X

[[ 1.00000000e+00 -3.88457302e-02]

[ 1.00000000e+00 -7.42217926e-04]

[ 1.00000000e+00 -9.46284244e-03]

...

[ 1.00000000e+00 -5.81378271e-02]

[ 1.00000000e+00 -3.15429207e-02]

[ 1.00000000e+00 4.09643405e-02]]

We now have our matrices, let’s perform the linear regression!

linear_model = np.linalg.inv((X.transpose()@X))@X.transpose()@Y

linear_model

[0.000544056413840724*x - 6.62061061591867e-5*y + 0.000429966553373172*z - 0.000178620725465344

0.0457830563134785*x + 0.118178191274045*y + 0.0659651260604729*z + 0.899115719100281]

Excellent. So we now have two rows; the top row represents the “bias”—how much deviation there is from CAPM, and the bottom row represents the “rate”—the “beta” value which represents how much excess variance there is.

Optimizing the Optimized Fund: Picking Optimizing Parameters

We can will solve for a combination of solutions to give us specific values of returns vs risk. For instance, we can fix the variance to 1 (i.e. we can vary as much as the market.) We subtract one here for the solver, which expects the expressions equaling to \(0\).

risk_expr = linear_model[1] - 1

risk_expr

0.0457830563134785*x + 0.118178191274045*y + 0.0659651260604729*z - 0.100884280899719

Now, we will set a certain earning value, and solve for possible solutions. We will try to get the largest possible bias without needing to short something (i.e. cause a negative solution). By hand-fisting a value, it seems 0.001 is a good bet.

deviance_expr = linear_model[0] - 0.001

deviance_expr

0.000544056413840724*x - 6.62061061591867e-5*y + 0.000429966553373172*z - 0.00117862072546534

Optimizing the Optimized Fund: Optimize!

solution = sym.solvers.solve([deviance_expr, risk_expr], x,y,z)

solution

{x: 2.16803104555387 - 0.819584899551304*z, y: 0.0137520589394366 - 0.24067066980814*z}

We have one degree of freedom here: how much MacDonald’s we want! Let’s say we want none (which would, according to this, be an equally efficient solution.)

How Does Our Fund Do?

This would create the following plan:

# for our case

z_val = 0

# numerical solutions

s_x = solution[x].subs(z,z_val)

s_y = solution[y].subs(z,z_val)

# solution

fund_2_nobias_nomac = s_x*returns.LMT + s_y*returns.TWTR + z_val*returns.MCD

fund_2_nobias_nomac.mean()

0.001185050286566688

Recall that this is the performance of the balanced portfolio:

fund_1_returns.mean()

0.0009224705380695683

So, for market-level risk (\(\beta =1\), instead of the balanced portfolio’s \(\beta =1.1290\)), this is a pretty good deal!

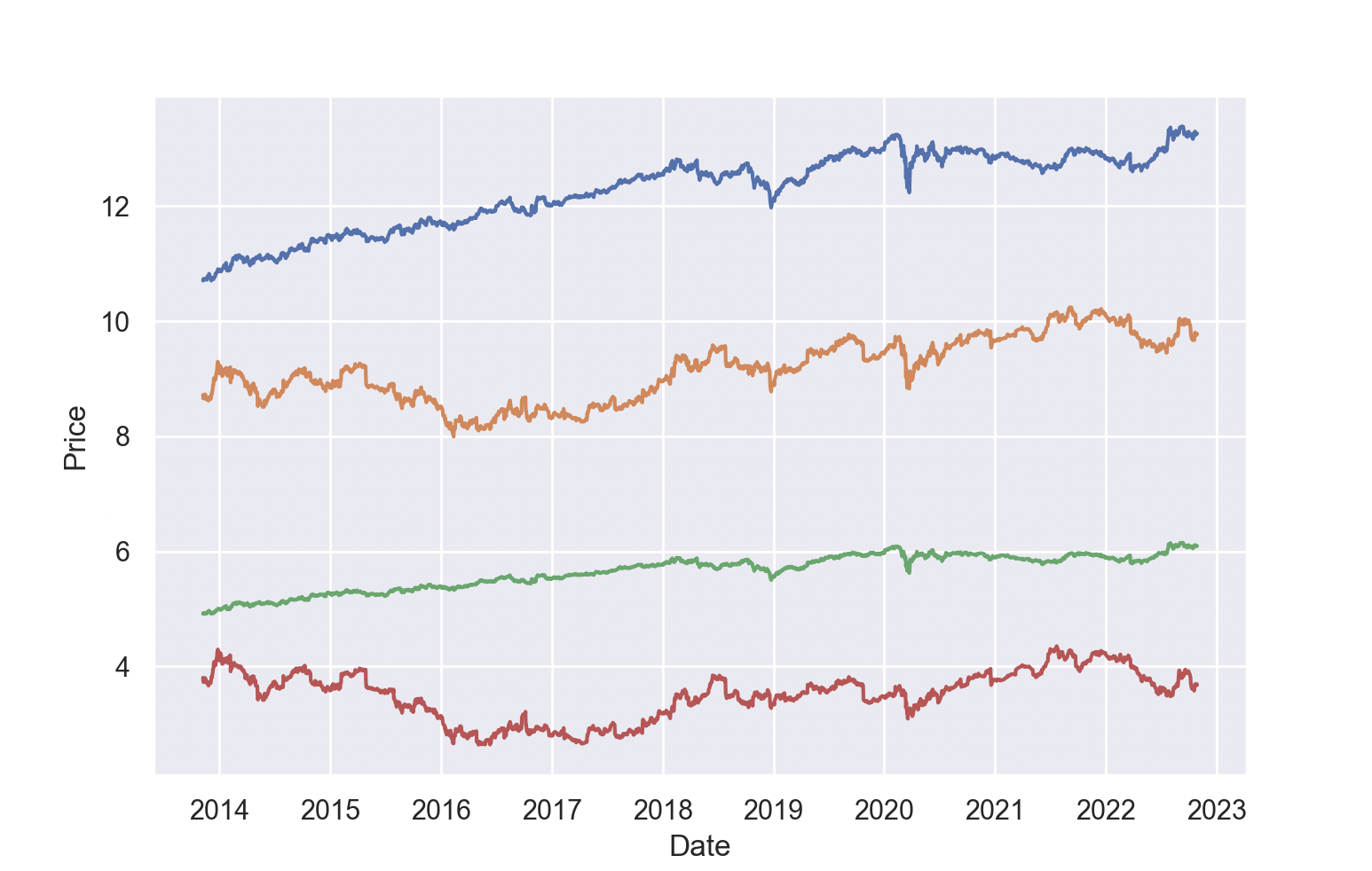

Some Plots

Finally, let’s plot the prices of our various funds:

import matplotlib.pyplot as plt

import matplotlib.dates as mdates

import seaborn as sns

from datetime import datetime

sns.set()

fund_2_price = s_x*df.LMT + s_y*df.TWTR + z_val*df.MCD

fund_1_price = df.LMT + df.TWTR

fund_l_price = df.LMT

fund_t_price = df.TWTR

dates = df.Date.apply(lambda x:datetime.strptime(x, "%m/%d/%Y %H:%M:%S"))

sns.lineplot(x=dates, y=fund_2_price.apply(sym.Float).astype(float))

sns.lineplot(x=dates, y=fund_1_price.apply(sym.Float).astype(float))

sns.lineplot(x=dates, y=fund_l_price.apply(sym.Float).astype(float))

sns.lineplot(x=dates, y=fund_t_price.apply(sym.Float).astype(float))

plt.gca().xaxis.set_major_locator(mdates.YearLocator())

plt.gca().xaxis.set_major_formatter(mdates.DateFormatter('%Y'))

plt.gca().set_ylabel("Price")

plt.show()

Recall that we didn’t actually buy any MacDonald’s. So, we have—blue, being our “optimal” portfolio, yellow, our balanced portfolio, green, being Lockheed, and red, being Twitter.

Our portfolio works surprisingly well!