iStudio Meeting Notes

Last edited: August 8, 2025| Date | Notes |

|---|---|

| PCP April Checkin | |

| Alivio April Checkin | |

| GreenSwing April Checkin | |

| Pollen April Checkin | |

| Logan’s Team Checkin | |

| Anna’s Team Checkin |

TODO Stack

- Get asthma kids leads for Alivio

- GreenSwing Hiring: Fufilling Orders, MechE

- Conrad money?

- Get Mentors for Pollen => Figma lady

Item Response Theory

Last edited: August 8, 2025If a student has ability \(a\), and a probably is \(d\) difficulty, the probability of a student getting something right:

\begin{equation} \sigma (a-d) \end{equation}

this doesn’t consider SLIPPING at all.

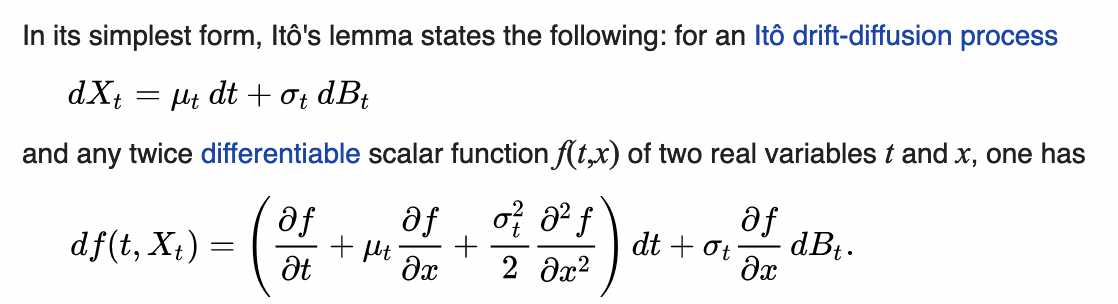

Itô Intergral

Last edited: August 8, 2025

https://en.wikipedia.org/wiki/It%C3%B4%27s_lemma

for integrating Differential Equations with Brownian Motion.