joint probability distribution

Last edited: August 8, 2025for random variables \(X, Y\), the joint probability distribution is the probability of both of them happening at once.

\begin{equation} p(x,y) \end{equation}

The most fundamental solution can be derived with a table where all complete probabilities are listed. They are going to be too large to practically store.

independent joint probability

For any given variable, the probability of the joint of two separate events is their product.

probability of the joint of a Bayes Net

\begin{equation} p(joint) = \prod_{i \in BN}^{} p(x_{i} | parents(x_{i})) \end{equation}

jokes

Last edited: August 8, 2025Punchlines

- Screw you, I’m not Stupid…. I’m just Chinese.

- Joke’s on you, I’m both Chinese AND stupid.

Setups

- Why is it that toilets have a refractory period?

- The satanic church fights back against the Texas abortion ban.

Completed jokes

- Where did Texas gun control funding go? its illegal to own more than 6 d*l**s there

- Not only did you have to pass normal tests, you had to pass like a thousand COVID tests

Jonell 2021

Last edited: August 8, 2025DOI: 10.3389/fcomp.2021.642633

One-Liner

Developed a kitchen sink of diagnoses tools and correlated it with biomarkers.

Novelty

The kitchen sink of data collection (phones, tablet, eye tracker, microphone, wristband) and the kitchen sink of noninvasive data imaging, psych, speech assesment, clinical metadata.

Notable Methods

Here’s their kitchen sink

I have no idea why a thermal camera is needed

Key Figs

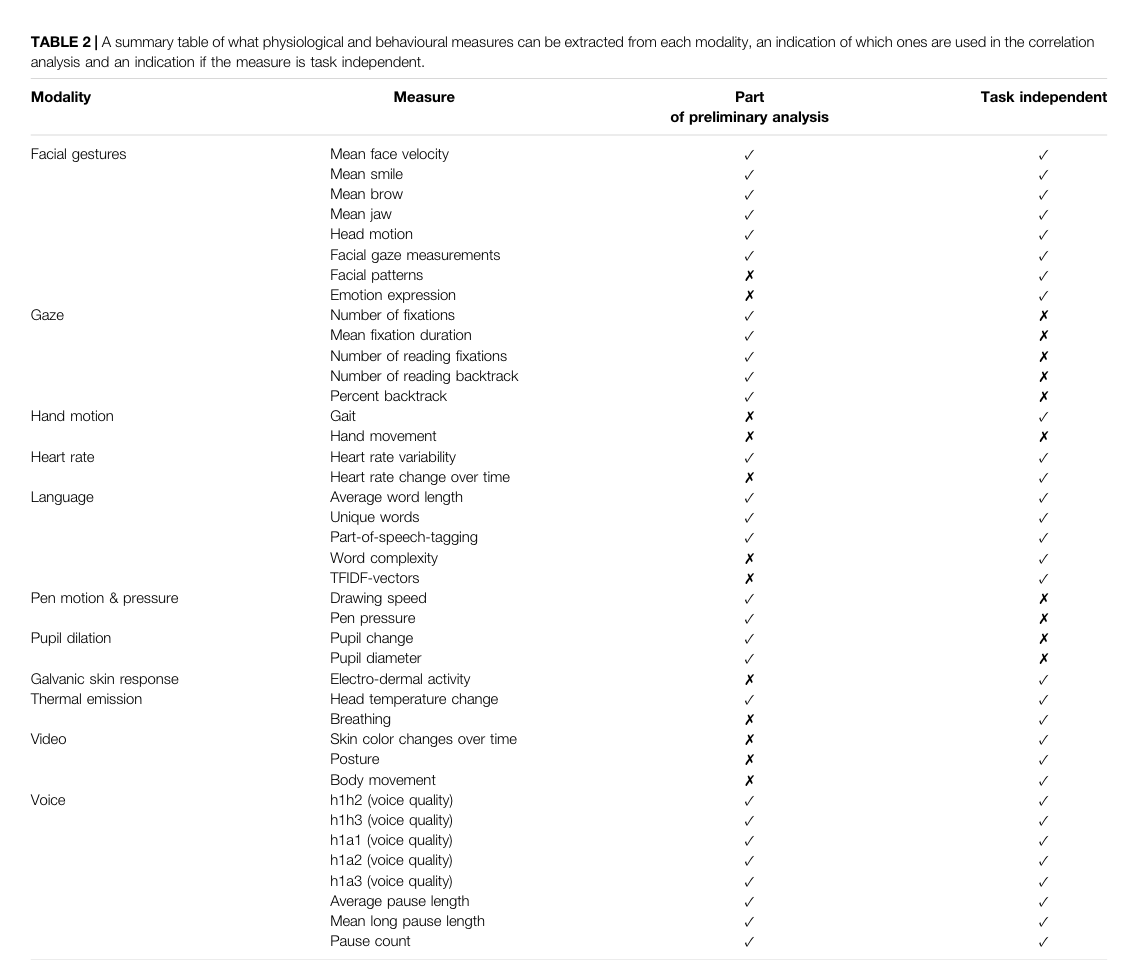

Here are the features they extracted

Developed the features collected via a method similar to action research, did two passes and refined/added information after preliminary analysis. Figure above also include info about whether or not the measurement was task specific.

JSJ

Last edited: August 8, 2025POMDPs can become computationally quite intractable. Alternative: a stochastic, memoryless policy. A policy should be stochastic in order to satisfy certain conditions during adversarial games (think bluffing).

JSJ is basically Q-Learning adapted for POMDPs:

\begin{equation} \begin{cases} Q^{\pi}(s,a) = \sum_{t=1}^{\infty}\mathbb{E}_{\pi} [r_{t}- R^{\pi}|s, a] \\ Q^{\pi}(o,a) = \mathbb{E}_{s}[Q^{\pi}(s,a) | M(s) = o] \end{cases} \end{equation}

where \(M\) is a mapping between states and possible observations.

Policy Improvement

Now, we want to maximise:

\begin{equation} \Delta_{o}(a) = Q(o,a) - V(o) \end{equation}

Ka'Chava

Last edited: August 8, 2025Ka’chava is described as a “superfood” which is used as a meal replacement to manage hunger.